Arunkumar and Associates, Chartered Accountants is a registered auditor firm based in Chennai, India. We provide the following services

- Statutory and internal audit

- Tax audit

- GST Registration, filing and audit

- Investigation audit

- System audit

- STPI registration

- Concurrent audit

- Bank audit

- TDS return filing

- Transfer pricing

- International Taxation

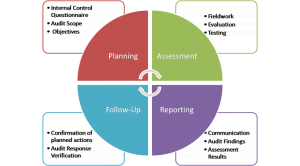

Auditing is no more just ticking of vouchers. Auditing is a tool to identify the weakness and improve the process. Our auditing process follow the process explained in the diagram below.

Contact us for your business requirement

Site Developed by Sakaye Infotech Pvt Ltd